Why are APIs Necessary for Banking and Fintech Industry?

Publish date: Feb 08, 2023

It is a system in which financial institutions like banks make their APIs available to outside parties so they may access the financial information of individuals.

A modest UK government effort from 2018 has now become a global phenomenon. Due to the popularity of open banking startups, the concept has permeated and influenced several financial institutions worldwide. In essence, it is a system in which financial institutions like banks make their APIs (Application Programming Interfaces) available to outside parties so they may access the financial information of individuals. This is then utilized to build new services and applications that give account holders alternatives for transparency.

A group of protocols known as banking APIs allows for safe communication between the client's devices and the server of their bank. Customers can communicate with bank staff using the bank's app with merely an internet connection. Since the interaction involves talking about money and transferring financial data, the banking APIs must be strictly authenticated and secured. Regarding the backend, these APIs link developers to payment networks so they may display billing information. This transforms them into a valuable tool for BaaS (Bank as a service).

What is a Financial API?

It's helpful to consider APIs in general before we can comprehend what a financial API is. A code called an API allows data to be transferred between programs. To function, one piece of software may incorporate hundreds of apps. Every application serves a distinct purpose. The user can obtain the knowledge they require to perform a service thanks to the API, which enables various programs to communicate. In the financial industry, APIs make it easier for the apps involved in financial transactions to communicate with one another. A financial API collects data from banks, customers, third-party retailers, and other sources to ensure that the marketing is correct and quick. APIs also keep track of transactions so that all parties can follow purchases. The most common applications for fintech APIs are in online banking, investing, and e-commerce, where third-party services require access to a user's financial data.

What are Banking APIs?

APIs are simple rules and instructions that specify how different software parts should interact. They are used to connect various software programs. Since open banking is so widely used, it has also become commonplace for fintech companies to employ APIs, which are used to give instructions to outside service providers. Additionally, according to reports from Insider Intelligence, APIs have been used to link developers to payment networks and display billing information on a bank's website. They are now an essential tool for BaaS (Banking-as-a-Service), an integral component of open banking.

Implications of APIs in the Fintech and Banking Sector

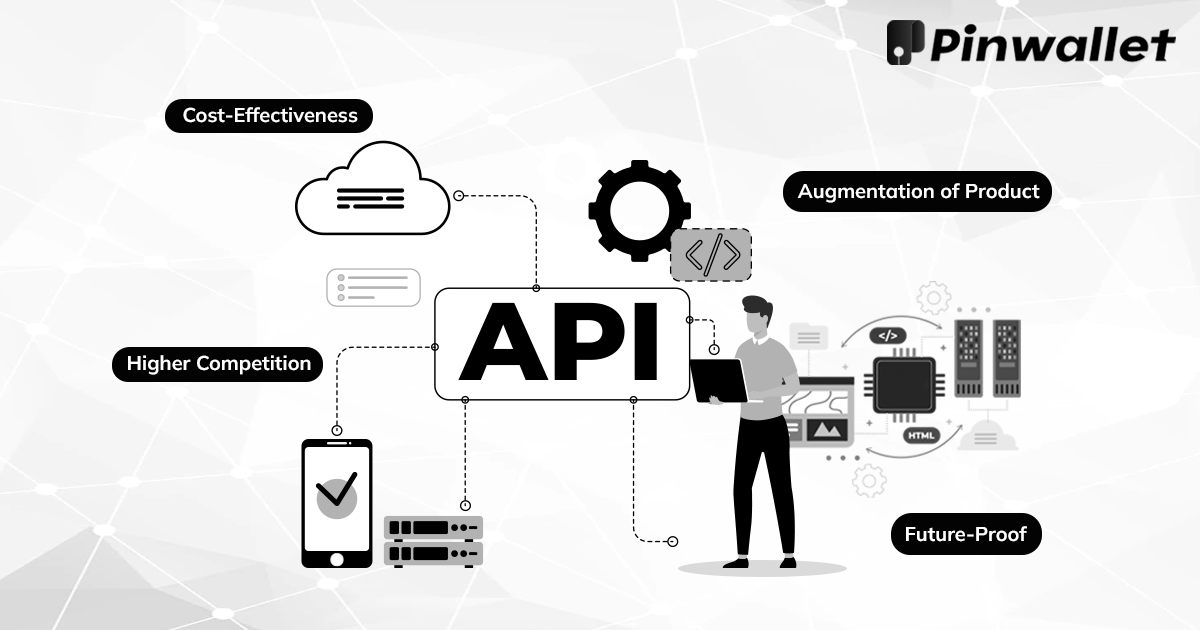

1. Boost Overall Cost-Effectiveness

Even if providing a wide range of banking services is advantageous for customers, it can be expensive or even cost-prohibitive for financial institutions. Here, we can observe one of the advantages of APIs for fintech. However, Open API development has proven to be a lifesaver in this regard, as customers may now take advantage of various services by integrating multiple applications. For instance, a user can quickly record their financial information in accounting software from a third party, keeping track of every important detail about the transaction and similar data in one location.

2. Promote Data Sharing for a Better Experience

In the past, banks were quite protective of customer data and fussy about releasing it. However, PSD2 (Second Payment Services Directive) completely altered the landscape, first in the European Union and later on a global scale. Now that individuals have complete control over their data, they can ask banks to share it with the third-party provider of their choice. And how is this made possible? Using open APIs. The use of APIs in fintech is just one of several.

3. APIs are Future-Proof

Since the number of fintech apps is increasing, banking API will likely remain relevant. Now and then, hundreds of fintech firms pop up, which only proves that there is enough demand from customers for businesses to continue working to provide better services by integrating APIs and other methods. According to a search on Programmable Web, there are 1956 financial APIs, compared to 290 listed in the first half of 2019.

4. Higher Competition means More Services

The introduction of APIs has enhanced market competitiveness, at least to the advantage of customers. As a result, prices in the financial sector are declining compared to the services provided. For instance, users can compare offerings from banks and other institutions using financial services aggregators. Additionally, customers now have access to previously only available amenities in branches.

5. Fast and Efficient Operations

Banks can efficiently serve their customers and give them a smooth experience by implementing an API-powered methodology. Through mobile, internet, and wallet services on their devices, APIs enable customers to manage banking transactions quickly and securely from anywhere. Customers can save valuable time by completing transactions without physically visiting the institutions. They can save a lot of money and resources because almost 90% of transactions occur outside a physical bank office, which helps them improve their financial health and well-being.

6. Augmentation of Product Portfolio

By enabling them to offer additional products like insurance or products they co-create with their partners and financial tech and innovation enterprises, API in banking is expanding its array of developing products. The adaptability of APIs that interface with many frameworks and enable exchange between enterprises and industries makes this portfolio growth possible. Banks can now sell non-financial products alongside financial ones because of APIs.

Conclusion

Considering how well-liked open banking startups are, open banking has become a global phenomenon. It is a mechanism whereby financial institutions allow third parties access to their APIs (Application Programming Interfaces) so that they can access people's financial information. APIs are straightforward guidelines that outline how various software components should communicate with one another. They are employed to foster data sharing for improved experiences and connect diverse software applications. In this context, open API development has shown to be indispensable, enabling users to benefit from a variety of services by integrating several applications.